-

Will vs. Living Trust vs. Living Will—What’s the Difference?

What is a Will?

A will outlines how you wish your assets and affairs to be handled after your death. It specifies who will receive your property, who will care for any minor children, and who will be responsible for executing your wishes. A will only takes effect after you pass away and must go through the probate process, where the court supervises the distribution of your estate. Wills are publicly available records, meaning anyone can look up the information they contain.

What is a Living Trust?

A living trust, or revocable living trust, is a legal arrangement where a trustee holds and manages your assets during your lifetime. Unlike a will, a living trust takes effect immediately upon creation. You can manage and benefit from these assets while you’re alive, and upon your incapacitation or death, they transfer to your beneficiaries according to your instructions without going through probate. This key benefit of a living trust speeds up the process, costs less, and provides privacy for your family.

What is a Living Will?

A living will is very different from a traditional will. Also known as an advance health care directive, this document outlines your wishes regarding medical treatment if you become incapacitated. It’s focused on your health care preferences rather than the distribution of your assets, covering decisions such as whether you want life-sustaining treatments, resuscitation, or pain management in certain medical situations.

Key Differences Between a Will, Living Trust, and Living Will

Purpose:

- A will manages asset distribution and guardianship after death.

- A living trust manages assets during life and after death.

- A living will directs medical care preferences when incapacitated.

Activation:

- A will becomes effective upon death.

- A living trust is effective immediately upon creation.

- A living will is effective when you’re unable to communicate your medical preferences.

Probate:

- A will is subject to probate.

- A living trust avoids probate.

- A living will is not related to probate or asset distribution.

Flexibility:

- A will can be updated any time before death.

- A living trust can be altered or revoked during your lifetime.

- A living will can be updated as long as you’re competent.

Choosing the Right Option for Your Needs

Selecting between a will, a living trust, and a living will depends on your unique circumstances and goals. Here are some considerations to help you decide:

- If you want a straightforward way to outline your final wishes and appoint guardians for your children, a will might be the best choice.

- If you wish to avoid probate, ensure seamless asset management, and maintain privacy, a living trust could be more suitable.

- If you want to ensure your healthcare preferences are followed when you can’t communicate them, a living will is a must.

Dying Without a Will or Living Trust

If you die without a will, known as dying “intestate,” your loved ones may face unintended complications. State intestacy laws will dictate how your assets are distributed, usually to the closest family members, but the specifics vary by state. Without a will, there is no named executor, so the court will appoint an administrator to manage the distribution of your assets. This process can be lengthy and stressful for your family, possibly causing disputes and delays in settling your estate.

Benefits of Professional Legal Advice

Creating the most advantageous estate plan is complicated. Having a knowledgeable attorney makes the process smoother and more effective. Professional legal advice provides customized solutions that reflect your specific needs and goals. You’ll receive expert guidance in navigating the legal requirements and potential pitfalls of estate planning for peace of mind that your documents are correctly prepared and legally enforceable.

Contact Bakerink, McCusker & Belden Today

You don’t need to be rich and famous to benefit from a will, a living trust, or a living will. Even if you are of modest means, you should create an estate plan if you have specific wishes about your end-of-life decisions, asset distribution, and child guardianship.

Bakerink, McCusker & Belden would be honored to help you craft or update your estate plan to meet your wishes. We have over 35 years of legal experience to guide you through your estate planning needs. Whether you need a will, a living trust, or a living will, our experienced attorneys are here to provide the legal guidance you deserve. Contact us today for a free, no-obligation consultation in Tracy, CA. We’ll help you plan for the future with confidence.

-

Estate Planning Terminology Every Adult Should Be Familiar

Estate law involves complex nuances of language, and the terminology can be baffling to non-lawyers. You can always count on a will lawyer near Tracy or Manteca to fully explain anything that isn’t clear to you. However, it’s still advisable for all adults to have a basic understanding of the most common estate planning terms.

Last Will and Testament

Your will dictates how, after satisfying debts, your remaining assets in your estate will be distributed to your heirs. Heirs are also called beneficiaries. You can use your will to distribute specific pieces of property if you wish, or to provide for your pets in the event that they outlive you. If you have any minor children, you should use your will to designate a guardian for them.

Guardian

A guardian is someone whom you trust to raise your minor children in the event that you die before they reach the age of majority.

Executor

The executor of your will is the person who will be responsible for seeing that its terms are carried out. Even when the executor works with a lawyer, he or she will have many complex responsibilities. Before designating an executor, you should ask that person if he or she is willing to take on these responsibilities.

Trust

A trust is a document that is legally binding. You can transfer assets into the trust during your lifetime. The trust manages the assets, and after your death, the trust distributes the assets to your beneficiaries.

Trustee

A trustee is a person whom you’ve designated to manage the trust. A trustee might also be a corporate entity instead of a single person. Trustees are responsible for administering and distributing the trust in accordance with the instructions in the trust document.

Probate

Probate is a legal process. It begins when the executor of a will files the will with the probate court in order to validate it. Validating a will means to prove that it’s legally valid. Probate involves paying the decedent’s debts and distributing the remaining assets.

-

What Is Probate?

After someone passes away in Tracy or Livermore, the probate process can begin. Probate is the process of filing a petition with the court to admit the will into probate or, in the absence of a will, appointing an estate administrator. When wills enter probate, they are publicly accessible. The decedent’s assets are inventoried and then the assets are transferred from the decedent to the heirs.

When you watch this video, you’ll hear a little more about probate and why some people might wish to avoid it. Since wills that enter into probate are publicly accessible, some people wish to avoid probate due to privacy concerns. It is also possible that the will may be contested. If you have any concerns about probate, a lawyer who handles estate planning cases can help you.

-

Guidance on Selecting the Right Trustee

If you have your lawyer establish a trust , then the trustee is responsible for administering the trust in accordance with your wishes after your death. In Tracy and Livermore, trust administration is a significant responsibility and often requires in-depth knowledge of estate planning matters. The trustee you choose can receive assistance from a law firm, but it’s still important to select a trustee who is capable of handling this responsibility.

Selecting a Family Member

It’s common to select a family member as a trustee or two select two family members to serve as co-trustees. If this is an option for you, then be sure to choose a family member who has solid business sense and good judgment. Your trustee should be expected to outlive you. Before settling on a relative, carefully consider whether family dynamics or family conflicts might interfere with the trustee’s ability to administer the trust in an appropriate manner. Even when a family trustee has the best of intentions at heart, he or she might be influenced to make an emotional decision. If you do decide to use a family trustee, make sure that person is willing to carry out these duties after your death.

Choosing a Professional Trustee

Many people choose a professional or corporate trustee. This option may be right for you if you do not have a family member whom you trust to faithfully administer the trust or if none of your relatives are willing to assume this role. Bear in mind that a corporate trustee will charge a fee, which might be a problem for trusts that are modestly funded. However, the advantage of choosing a corporate trustee is that he or she won’t be swayed by family dynamics or conflicts.

Authorizing a Relative and an Independent Advisor

It is possible to find a middle ground between choosing a family trustee versus a corporate trustee. You might decide to select a trustworthy family member to serve as a trustee, but then to also hire an independent investment advisor. This advisor could provide guidance to the trustee without charging the same high fee that would be typical of a corporate co-trustee.

-

What Are the Components of a Complete Estate Plan?

Estate planning can be complicated, but delaying getting your affairs in order may lead to undesirable consequences. If you’ve experienced a change in life circumstances, such as the birth of a child, a marriage, or the death of a family member, it’s time to make an appointment with a will lawyer with offices in Tracy or Livermore. Your estate planning attorney will walk you through the process step-by-step.

Estate planning can be complicated, but delaying getting your affairs in order may lead to undesirable consequences. If you’ve experienced a change in life circumstances, such as the birth of a child, a marriage, or the death of a family member, it’s time to make an appointment with a will lawyer with offices in Tracy or Livermore. Your estate planning attorney will walk you through the process step-by-step.Will

Wills are a cornerstone of estate planning. A will serves several functions, including providing for the distribution of your property in accordance with your wishes. If you die intestate, which means without a last will and testament, then your property may be distributed in accordance with the laws of your state. Of course, it is not necessary to list every valuable item you own in your will. A simple will may leave all of a person’s possessions to his or her significant other. Or, you may designate most of your possessions to one person, with the exception of certain family heirlooms to be passed along to other individuals. You can also use your will to make charitable contributions and designate an executor. If you have minor children or you care for a permanently disabled individual, you can use your will to designate guardians .

Beneficiary Designations

You may have other beneficiaries in addition to those you name in your will. If you have a life insurance policy, you should check your designated beneficiaries and update this information if need be. You may also designate beneficiaries for your retirement plans.

Trust

You may choose to have your estate planning attorney establish a trust, which may provide tax advantages for your heirs. You can also use a trust to control the distribution of property after your death. For example, you may wish to leave assets to your minor children, but you may not necessarily want them to have access to the funds right away. You could structure your trust so that your children will receive a certain amount at specific intervals. A trust can help prevent financial irresponsibility among younger beneficiaries.

-

How Often Do Wills Need to Be Updated?

Even if you have already established a will , you may need to make some changes to it from time to time. As this video explains, it’s a smart idea to review your will every few years to make sure that everything is up to date and to make any desired alterations. You may also need to update your will after major changes in your life, such as remarriage, the birth of a child, or the death of a beneficiary. However, altering a will needs to be done in a legal way in order to be considered valid. To ensure that you are carrying out your will updates correctly, contact a will attorney serving Tracy.

-

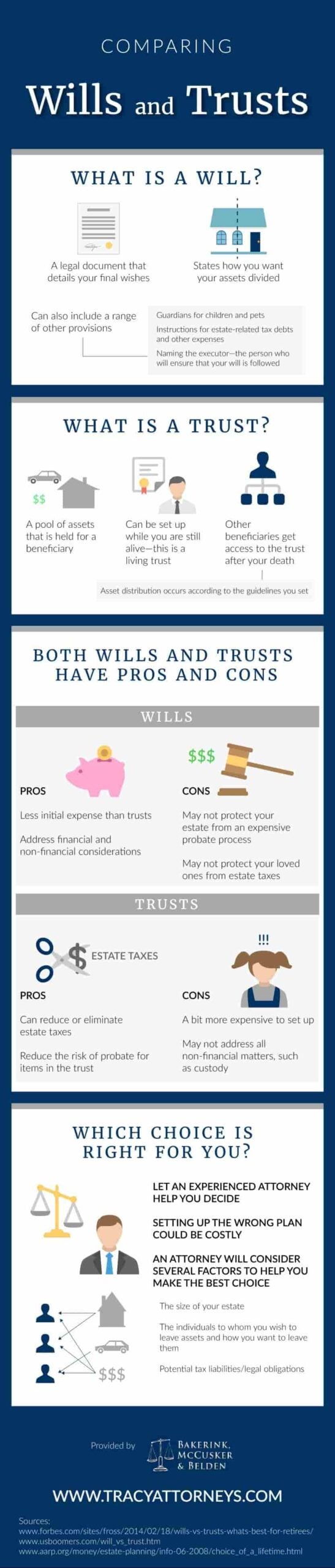

Comparing Wills and Trusts

Although making plans for your estate may be uncomfortable, it is one of the most important things you can do for your family. Two options you have are wills and trusts. Wills are legal documents that detail your final wishes, from who you wish to receive the assets in your estate to who should gain guardianship of your pets. Trusts can be set up while you’re alive and are a pool of assets that can be used by your beneficiaries. When you are alive, you are the beneficiary of your trust, and after your death, it will pass on to the people you have designated. Let one of the attorneys in Tracy at Bakerink, McCusker & Belden help you understand whether a will or trust is appropriate for your needs and help you set one up that adequately protects your family. Start a conversation with your family about estate planning by sharing this information.

-

A Look at Common Mistakes People Make in Wills

Establishing a will is an important step for everybody, but one simple mistake can prevent your final wishes from being carried out. Fortunately, it’s easy to avoid these mistakes—as long as you know what to expect. Working with an estate planning attorney near Tracy can help you steer clear of these common will errors:

Establishing a will is an important step for everybody, but one simple mistake can prevent your final wishes from being carried out. Fortunately, it’s easy to avoid these mistakes—as long as you know what to expect. Working with an estate planning attorney near Tracy can help you steer clear of these common will errors:Neglecting to include all of your property. If asked to name everything they own, most people would probably forget to include a few things. If your will does not include a residuary clause and you do not list everything you own, your will is considered incomplete and your remaining assets will be disposed of by the state. Meeting with a will attorney will help you ensure that all of your assets are accounted for and that nothing is overlooked.

Failing to appoint the right executor. Choosing an executor to administer your estate is one of the most important aspects of drawing up a will, so make sure that you select a trustworthy individual. In the event that your executor is no longer the best person for the task, you will need to alter your will and select a new executor.

Forgetting about estate taxes. When drawing up a will, many people neglect to take estate taxes into account. While you may assume that your estate is not worth enough to be taxed, you should still talk to a will attorney to determine which of your assets are taxable. Estate tax laws change from time to time, so an attorney can ensure that you are kept up to date on the current regulations.

Include all beneficiaries. Before you establish your will, you should take some time to determine who your beneficiaries will be. While you can change your will later, for the sake of convenience it’s best to decide who you wish to include. Generally, you should not have witnesses who are named as beneficiaries in your will.

Failing to update after major life changes. If you have gotten married or divorced, welcomed a child into your family, moved, or started a business, that change should be incorporated into your will. It’s easy to put off these adjustments, but the sooner you change your will, the sooner you will have peace of mind.

-

Answers to Your Questions About Writing a Will

There are many factors to consider when writing a last will and testament. Before you meet with a lawyer to discuss estate planning near Tracy and Livermore, you should write a list of your assets and consider which beneficiaries you wish to leave them to after your passing. You may also wish to write a list of questions you have for your estate planning lawyer ; he or she is your best source of information regarding estate administration.

There are many factors to consider when writing a last will and testament. Before you meet with a lawyer to discuss estate planning near Tracy and Livermore, you should write a list of your assets and consider which beneficiaries you wish to leave them to after your passing. You may also wish to write a list of questions you have for your estate planning lawyer ; he or she is your best source of information regarding estate administration.Do I Need a Will?

If you are a legal adult, it might be a good idea for you to have a will even if you do not yet have significant assets. Should something happen to you and you pass away without a will, this is known as dying intestate. In this case, your state’s intestate succession laws will dictate who will inherit your property. This may not be in accordance with your preferences. If you have a minor child and you die without a will–and if the other parent cannot care for the child–then the state will designate a guardian for your child . The state’s laws will also determine which property the child can inherit.

What Elements Are Necessary for Legal Validity?

The laws of estate planning vary from state to state; however, most wills must have certain elements to be legally valid. For example, you must be at least 18 years old and you must be of sound mind. The will must contain at least one provision for the guardianship of minor children or for the distribution of property. It must appoint an executor and it must state specifically that the document is the testator’s will. Additionally, you and two witnesses must sign the document.

Shouldn’t My Spouse and I Have a Joint Will?

If you and your spouse file a joint tax return, you might assume that it makes sense to have a joint will. But in fact, this is almost never a good idea, since it’s unlikely that you and your spouse will pass away at the same time. Additionally, you or your spouse may have property that is held individually, rather than jointly.

-

Understanding the Basics of Estate Planning

Far too many people die intestate, which means they pass on without a will. When this happens, their assets are dealt with in accordance with state intestate succession laws. In some cases, when an heir cannot be identified, it is possible for the state to claim these assets. You can easily avoid these problems by consulting an estate planning lawyer in Tracy or Livermore. Your estate planning attorney will carefully review your finances, offer sound recommendations, and provide you with all the information you need to make wise decisions for your heirs.

Will

A last will and testament is a crucial document to have, regardless of your health or age. As your circumstances change, you may wish to visit your lawyer to have your will revised. For example, if you have more children or if grandchildren are born, you may wish to adjust your will to reflect your new inheritance preferences. Your lawyer will draft your will for you to ensure that your assets are distributed in accordance with your wishes after you pass on. Your will can be as detailed as you like. For example, some people simply prefer to leave all their assets to their spouse, while others prefer to designate heirs for specific items. You might leave a valuable jewelry collection to a granddaughter, for example, and leave a vehicle to a sibling. You can alsouse your will to leave gifts for your favorite charities. For parents and legal custodians, having a properly drafted will is particularly important. Your will can designate a guardian for any children who are still minors when you pass on. If you take care of someone who is mentally or physically incapacitated, you will also need to designate a guardian for that individual.

A last will and testament is a crucial document to have, regardless of your health or age. As your circumstances change, you may wish to visit your lawyer to have your will revised. For example, if you have more children or if grandchildren are born, you may wish to adjust your will to reflect your new inheritance preferences. Your lawyer will draft your will for you to ensure that your assets are distributed in accordance with your wishes after you pass on. Your will can be as detailed as you like. For example, some people simply prefer to leave all their assets to their spouse, while others prefer to designate heirs for specific items. You might leave a valuable jewelry collection to a granddaughter, for example, and leave a vehicle to a sibling. You can alsouse your will to leave gifts for your favorite charities. For parents and legal custodians, having a properly drafted will is particularly important. Your will can designate a guardian for any children who are still minors when you pass on. If you take care of someone who is mentally or physically incapacitated, you will also need to designate a guardian for that individual.Trust

Another basic component of estate planning is creating trusts. A living trust goes into effect during your lifetime, while a testamentary trust goes into effect after your death. You can transfer certain assets to a trust to protect them and reduce the tax burden. Trusts allow for the speedy distribution of assets to beneficiaries after a death. They may also place limitations on inheritances.

RECENT POSTS

categories

- Uncategorized

- Personal Injury

- Estate Planning

- customer reviews

- Financial Planning

- Work Injury

- Tracy Lawyer

- Attorney

- Dog Bites

- Auto Accident

- Slip and Fall

- Car Accident

- Living Trusts

- Trust Administration

- Living Will

- Wrongful Death

- Probate

- advanced health care directive

- About Us

- Russian linguist

- Infographic

- Wills and Trusts

- Will

- Car Crash

- Executor

- Whiplash Injuries

- Estate Taxes

- Slip and Fall Injury

- Auto Accident Claims

- Intestate Succession

- Disinheritance

- Trust Administrators

- Cycle Accident

- Accident