-

What to Look For in an Estate Planning Attorney

An estate planning lawyer in Tracy can manage your estate during your life and properly allocate assets upon your death. This is a significant responsibility, so it is essential to find an attorney who is properly qualified with sufficient experience in estate planning. One way to assess a potential attorney’s experience is by checking if he or she is backed by a leading council agency.

In this video, an attorney explains how to find and consult with an estate planning attorney. As she explains, you should check client reviews and make sure your attorney is a good fit for your personality. You should also ask specific questions about communication to determine how transparent he or she will be in planning and managing your estate. In addition, it is a good idea to discuss initial consultation fees during your first interaction.

-

Answering FAQs about Estate Planning

Regardless of how substantial or modest an estate is, estate planning is essential. By working with an estate planning lawyer in Tracy or Livermore, you can ensure that your final wishes will be carried out. It’s not uncommon for individuals to try to handle their own estate planning needs. However, this is usually not a good idea. An estate planning attorney can help you with so much more than just drafting your will; he or she will make sure your will is valid and can be upheld in court. Your attorney can also help you make informed decisions by explaining estate planning options that you may not yet be aware of.

What Happens If I Die Intestate?

When a person dies intestate, it means that he or she has passed on without a will. After this occurs, that individual’s estate is subject to division according to state laws. Typically, assets are distributed to immediate family members, such as the surviving spouse and children. This could be problematic for those who do not want their assets to go to these individuals.What Is Probate?

State laws for probate vary. In general, however, it is the process by which a will is recognized as valid and the executor is given the authority to distribute assets. Probate is supervised by the court. It is possible to avoid probate by transferring assets to a trust. If a trust is created, a trustee will transfer assets to the appropriate parties after your death. How Is a Will Made Valid?

How Is a Will Made Valid?

Ensuring that the will is valid is one of the many benefits of having a lawyer handle your estate planning. In order to execute a will, you must sign it in front of witnesses.What Happens If I Own Joint Property?

There are some limitations on what a will can and can’t do. For example, it cannot direct the transfer of jointly owned property. For example, if you own a house with your spouse, full ownership will transfer to your spouse upon your death. Joint ownership offers some advantages. If you wish, you can add a family member’s name to a bank account, for example, and specify that the individual has the right of survivorship. This means that upon your death, that individual would have access to funds in that account to pay your bills and funeral expenses. -

Determining Your Wishes

While wills allow people to distribute their assets following death, living wills allow people to express their wishes to their doctors in case of incapacitation. Someone who drafts a living will with a will lawyer near Tracy and Manteca can outline whether or not to artificially prolong life if a devastating injury or illness occurs. Oftentimes, a will lawyer will combine the living will with a health care proxy, which designates someone to make health care decisions in cases of incapacitation.

Determining Your Wishes

If you create a living will, this written document will outline what medical treatments you approve for keeping you alive. You can also outline other medical decisions, including pain management and organ donation. Making these kinds of decisions can be difficult, so you need to closely consider your values. For example, consider how important it is for you to be independent and self-sufficient. You should also talk with your attorney about whether or not there are any situations in which you would like your treatment extended. For example, assess whether you would only want treatment if recovery is possible. Getting Advice

Getting Advice

A great way to evaluate your wishes in your living will is to talk to your doctor, health care agent, or family and friends. Tapping into these resources can help you organize your thoughts and feelings about end-of-life care. Additionally, resources to help you make this important decision are available through the American Bar Association, the Center for Practical Bioethics, and the Conservation Project.Addressing Possible Decisions

If you are unsure of any possible end-of-life care decisions, you should seek clarification from your doctor or another trusted medical professional. In your living will, you need to address resuscitation, which restarts your heart if it has stopped beating. You will also need to determine whether you want mechanical ventilation, which takes over breathing if you are unable to breathe on your own. In this situation, you need to determine if and for how long you would allow mechanical ventilation. Other issues to discuss with your attorney include tube feeding, dialysis, and organ donation. -

State Certification in Estate Planning, Trust, and Probate Law

Michael C. Belden is an estate planning lawyer in Tracy who is also a specialist in Estate Planning, Trust & Probate Law, certified by the State Bar of California Board of Legal Specialization. This program is a California Supreme Court-approved method for certifying attorneys as specialists in different areas of law. In earning this distinction, Mr. Belden had to successfully pass a written examination, attend a number of education programs, complete specific tasks in Estate Planning, Trust & Probate, and undergo a peer review.

Michael C. Belden is an estate planning lawyer in Tracy who is also a specialist in Estate Planning, Trust & Probate Law, certified by the State Bar of California Board of Legal Specialization. This program is a California Supreme Court-approved method for certifying attorneys as specialists in different areas of law. In earning this distinction, Mr. Belden had to successfully pass a written examination, attend a number of education programs, complete specific tasks in Estate Planning, Trust & Probate, and undergo a peer review.In order for Mr. Belden to register to become an estate law specialist, he needed to practice in the specialty area for a certain period of time. Once Mr. Belden passed the Legal Specialist Examination, he is eligible to continue on in the certification process. Through this rigorous process, the State Bar of California ensures that Estate Planning, Trust & Probate Law specialists have the knowledge and experience necessary to help his clients.

-

Meet Attorney Michael C. Belden

At Bakerink, McCusker & Belden , our attorneys in Tracy are dedicated to providing our valued clientele with comprehensive legal guidance in our areas of specialization. Attorney Michael C. Belden, one of our partners, has extensive experience in the areas of estate planning, probate, trust administration, and bankruptcy. In 2014, the State Bar of California Board of Legal Specialization granted Mr. Belden the designation of Certified Specialist in Estate Planning, Trust, and Probate Law. The exhaustive certification process involved a number of continuing education programs, peer reviews, and an intensive examination.

Before Mr. Belden joined our law firm, he served as Assistant Banking Center Manager for Bank of America. He later reviewed appellate cases for the Civil Justice Association of California. Mr. Belden joined the law offices of Bakerink & McCusker as a law clerk in 2003, focusing on estate planning and related matters. He graduated from University of the Pacific, McGeorge School of Law in 2005 and was subsequently admitted to the California State Bar. Since joining our law offices, Mr. Belden has demonstrated an exemplary commitment to client education and counseling.

Before Mr. Belden joined our law firm, he served as Assistant Banking Center Manager for Bank of America. He later reviewed appellate cases for the Civil Justice Association of California. Mr. Belden joined the law offices of Bakerink & McCusker as a law clerk in 2003, focusing on estate planning and related matters. He graduated from University of the Pacific, McGeorge School of Law in 2005 and was subsequently admitted to the California State Bar. Since joining our law offices, Mr. Belden has demonstrated an exemplary commitment to client education and counseling. -

When to Start Estate Planning

There is no set age at which individuals should consult an estate planning lawyer in Tracy. Many people only begin to think about estate planning when they encounter a major milestone in life, such as starting a family, buying a home, or starting a business. Others only begin to consider estate planning after they have been diagnosed with a serious illness. However, you can consult an estate planning attorney at any time. In fact, it’s advisable to develop an estate plan sooner, rather than later, since catastrophic events can strike at any time.

You can learn more about the importance of estate planning by watching this video. This expert warns viewers what will happen if they lack an estate plan and highly recommends consulting an attorney for in-depth legal guidance.

-

What Estate Planning Attorneys Do

You can consult an estate planning attorney near Tracy for legal guidance on a variety of matters. Estate planning involves arranging for the transfer of assets after your death , such as your home, savings, and investments. Estate planning also involves establishing a trust, living trust, and living will. You can turn to your estate planning attorney when you need to draft your last will and testament.

Watch this video for more helpful information on estate planning and the services your attorney can perform. This expert explains how careful estate planning can minimize the burden placed on your heirs. He also discusses why families might turn to an estate planning lawyer after the passing of a loved one.

-

How Estate Planning Can Benefit You

Estate planning is often thought of as matters pertaining only to the drafting of a last will and testament. But in fact, estate planning near Tracy may also involve making provisions for the continuation of your business and planning for your own future. Estate law is a complex area. When it’s time to organize your affairs, turn to a lawyer with expertise in estate planning.

Taking Care of Your Family

There are many ways in which estate planning can benefit your family. Often, when a loved one passes on, the surviving family members experience financial difficulties, which can be compounded by the will being stuck in probate. A skillful estate planning lawyer may be able to use state laws to your family’s advantage, such as by enabling them to receive partial payments while they wait. You can accomplish much more with your will than just distributing your assets. If you have children under the age of 18, you can use your will to designate their guardian in the event of your death. Of course, it’s customary for spouses to name each other as the guardian in the event of a death. However, you can also name a secondary guardian, such as an adult sibling, aunt, or uncle in the event that both you and your spouse pass on before your children become adults.

Planning for Your Future

An estate planning attorney can help you express your personal preferences in the event that you become physically or mentally incapacitated. You can designate durable healthcare powers of attorney to make medical decisions in accordance with your preferences. You can also have a living will drafted, which will specify which medical treatments you want or don’t want in the event of certain circumstances.

Facilitating Succession for Your Business

Facilitating Succession for Your Business Many small business owners rely on estate planning lawyers to help them plan for the succession of their businesses in the event of death. If you own a small business, planning these matters in advance will spare your loved ones the burden of deciding what to do about your business.

-

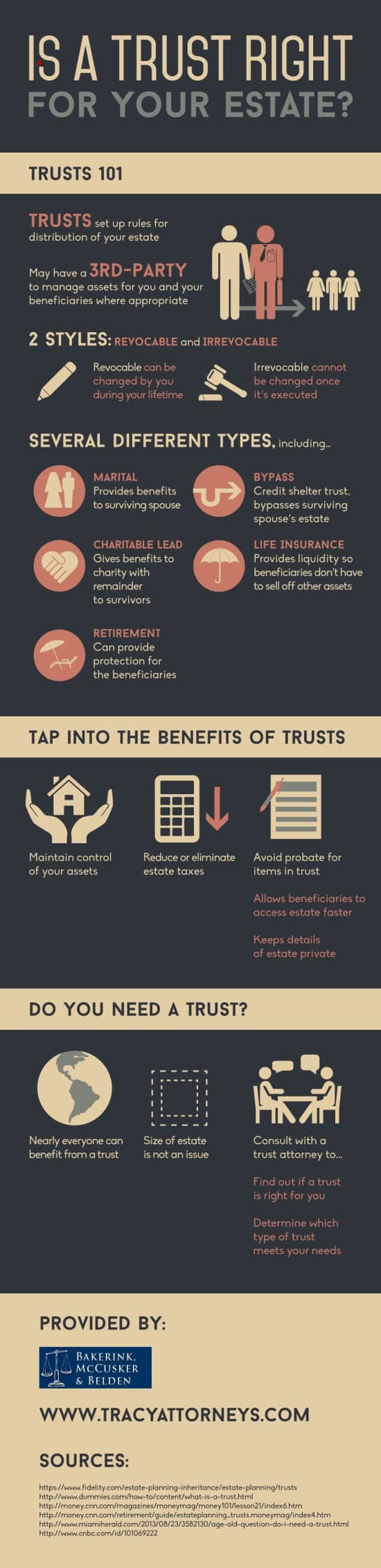

Is a Trust Right for Your Estate? [INFOGRAPHIC]

When estate planning, most people mistakenly believe that trusts are reserved exclusively for the wealthy. In fact, nearly anyone can benefit from setting up a trust. A trust simply gives you control over how your assets are distributed after you pass. In addition to giving you that extra control, trusts can help your beneficiaries avoid estate taxes and probate proceedings. In this infographic from Bakerink, McCusker & Belden Law , attorneys offering estate planning in Tracy, you’ll learn how trusts work and who can benefit from them. To find out which kind of trust is right for you, contact one of our lawyers. You can also arm your family and friends with the knowledge they need for estate planning by sharing this information with them.

-

An Overview of the Steps of Planning a Will

It’s all too common to delay creating a will until a serious illness strikes or an individual celebrates a milestone birthday. Many people delay consulting a lawyer regarding estate planning because they expect to lead a long, healthy life. While this is certainly ideal, a catastrophe can strike at any time. It’s advisable for all adults to work with Bakerink, McCusker & Belden a lawyer in Tracy to create a will. By establishing a last will and testament, you can protect your family’s future.

Evaluating Your Assets

Before you sit down with your lawyer to write your will, make a list of all of your assets. This list should include your bank accounts, real estate, retirement funds, life insurance policies, and various investments. It should also include personal assets such as your vehicle, art collections, jewelry, and other items of significant financial or sentimental value.

Designating Beneficiaries

Designating Beneficiaries Once you have a complete list of all of your assets, it’s time to decide who your beneficiaries will be . You can designate as few or as many beneficiaries as you wish. You may bequeath your liquid assets to your children, for example, and your real estate to your spouse. You may wish to divvy up family heirlooms among your beneficiaries. Bear in mind, however, that certain assets cannot be distributed with a will. This includes any property that you hold jointly. By law, this property will pass to the surviving owner. For example, if you own a house with your spouse, your spouse will automatically receive full ownership of the house upon your death.

Designating Legal Guardians

It’s widely known that wills are used to bequeath assets; however, many people overlook another important aspect of a will: Designating legal guardians. If you have children under the age of 18, you can use your will to designate a legal guardian upon your death. It’s common to designate a spouse as legal guardian and to designate another family member, such as a sibling, as the secondary guardian in the event that your spouse does not survive.

RECENT POSTS

categories

- Uncategorized

- Personal Injury

- Estate Planning

- customer reviews

- Financial Planning

- Work Injury

- Tracy Lawyer

- Attorney

- Dog Bites

- Auto Accident

- Slip and Fall

- Car Accident

- Living Trusts

- Trust Administration

- Living Will

- Wrongful Death

- Probate

- advanced health care directive

- About Us

- Russian linguist

- Infographic

- Wills and Trusts

- Will

- Car Crash

- Executor

- Whiplash Injuries

- Estate Taxes

- Slip and Fall Injury

- Auto Accident Claims

- Intestate Succession

- Disinheritance

- Trust Administrators

- Вечірні сукні

- Весільний салон Київ

- Весільні та Вечірні Сукні